Double entry for disposal of motor vehicle under hire purchase. Original cost 6349500 Motor Vehicles Sale price 6060000 inc 1010000 VAT Acc Dep 1269900 Outstanding Finance 5013113 HIre Purchase HP Interest 145460 HP Interest Paid to us 1046887 currently in our revenue account unreconciled VAT on the sale 1000000 I am really at a loss of how to do the.

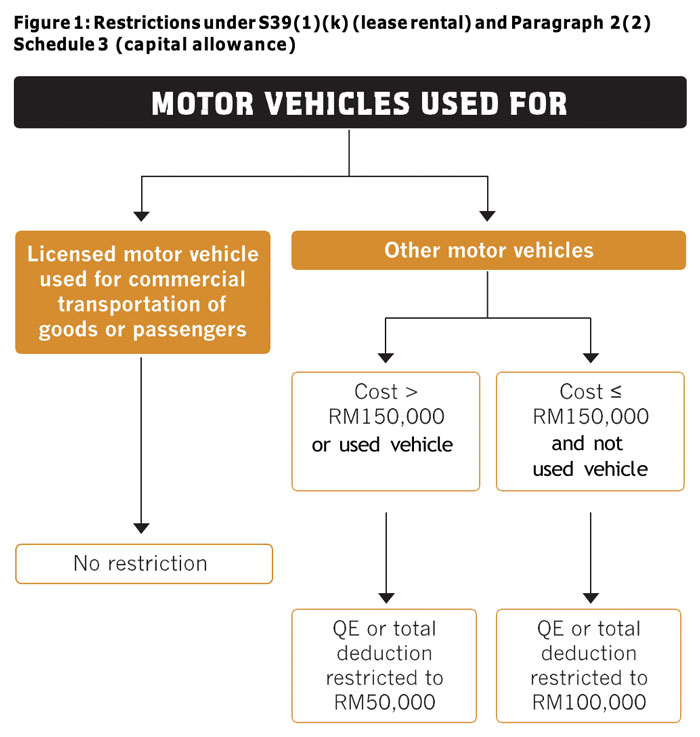

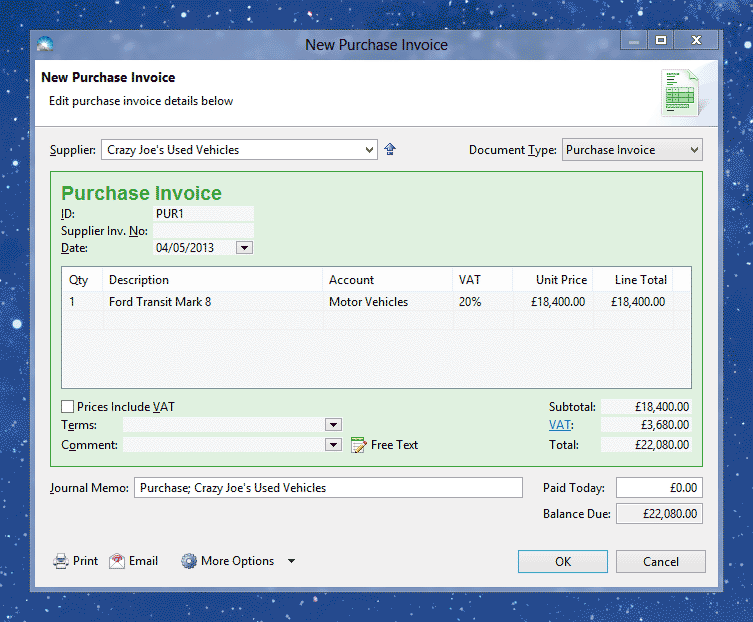

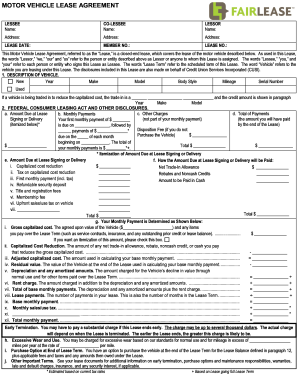

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

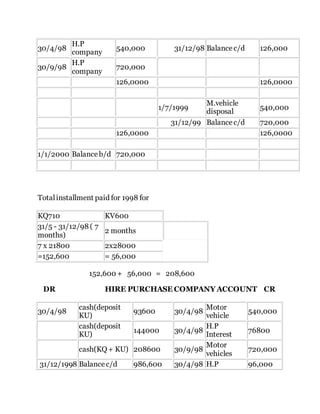

Credit Hire Purchase 19200.

. Assuming you purchase a new Office Equipment at 20000 and financed it with a Hire Purchase plan. 1050 Debit Interest in Suspense. The interest rate per annum is 388 flat.

Abby bought a car proton preve with hire purchase facility for amount of rm 75000 not included insurance of rm1130 road tax of. To offset the Fixed Asset Account. You need to account for GST when you sell the motor vehicle even if you are not entitled to claim input tax for the purchase.

CR Disposal of Motor Vehicle Account. You are acquiring a motor vehicle that costs RM17500000 with a 5-year hire purchase plan. A For buying assets on hire purchase.

If the cash price was 7000 plus 1225 of VAT which was reclaimed as input tax the double entry is. CR BS HP Liabilities 7000. Charging Output Tax for Sale.

If the cash price was 7000 plus 1225 of VAT which was reclaimed as input tax the double entry is. Total Interest charge base on 5 interest. Motor Vehicle ABC XXXX Fixed Asset Dr.

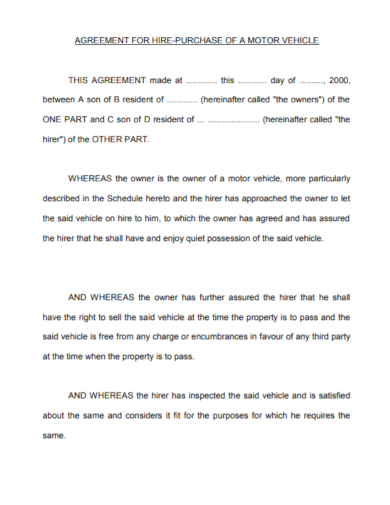

A fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on an old vehicle. The hire-vendor treats the hire purchase sale like an ordinary sale. Claiming Input Tax for Purchase.

The accounting entries would be as follows. For example the company purchase a car of RM70000. They end up paying 80000 only.

DR Disposal Of Motor Vehicle Account. Old Van 1500000 this removes the old van Debit. Enter Your Zip Code.

The interest rate per annum is 5. It simply means the company sells an old car for 20000 and buys a new car that costs 100000. 63900 x 35 month.

If the total payments are only 8225 the HP company is not charging any interest. This article demonstrates how you can record a hire purchase transaction of an asset with monthly instalment. Find Up To Four Waste Removal Pros.

The double entry of the Enter Bill transaction. A and company ABC have made the hire purchase agreement of the car. The payoff was 1315538 and we sold the vehicle to a dealer for 10000 and then wrote a check from our personal account for 315538 to make up for the difference on the loan.

Journal entry for disposal of motor vehicle under hire purchase Chapter 2 accounts of implementation of implementation of implementation of implementation of 1967 amendment and Islamic perspective 211 definition of purchase section 21 Law on the purchase of rental 1967. When transactions or event happen we record them. New Van 5000000.

Deposit Paid Current Assets Cr. You have put down a deposit down payment of RM7500000 which means the financed amount is RM10000000. It is not the discount but the net off of old car value for a new car.

Purchase and Sale of Motor Vehicles. Cash 4200000 this is the amount spent for the new van We would also make entries to start taking. Initial payment 10000 30 3000.

In cases of small owner managed companies where a second hand car is the economic option it could be more effective for a sole director to purchase it himself and claim AMAP mileage allowances. He pay 20000 for down payment. The interest paid was 4890.

When a business has a disposal of fixed assets the original cost and the accumulated depreciation to the date of disposal must be removed from the accounting records. When received part payment from buyer. Journal Entries in the books of Purchaser.

DR BS Motor Vehicles 7000. 1050 Debit Interest in Suspense. Therefore the remaining 50000 is paid using hire purchase facilities for 6 years.

You create both the Interest in Suspense and Hire Purchase account as a Long-Term Liability since the payment term is more than a year. The figures are as follows. Debit Cost of Office Equipment 15000 Debit GST Input.

P11D value Just a note of warning where a company buys a second hand car - the director will be taxed on the benefit at list price when new. The agreement that includes the assumption of goods and at the same time giving a. Since it was exchanged for fair value of 5000 and had a net book value of 6000 17000 11000 the loss.

The monthly payment over 3 years is equal to 200. A disposal of fixed assets can occur when the asset is scrapped and written off sold for a profit to give a gain on disposal or sold for a loss to give a. Journal Entry for Sale of a Vehicle with a loan.

The double entry will be. HP Interest in Suspense ABC XXXX Negative Current Liability Cr. Road Tax Insurance Expenses Cr.

Amount Owing to Director Current Liabity Cr. Under cash price method we are deal hire purchase transactions just like normal transactions. What are the correct journal entries for the sale of a vehicle with a loan.

CR Fixed Asset Account - Motor Vehicle. The journal entries for the illustration number 3 given above under this method will be as under. First we need to calculate the loss on disposal of the old motor vehicle.

You may claim the GST incurred on the purchase of a motor vehicle if it is not disallowed under the GST law. Accounting for Disposal of Fixed Assets. Hire Purchase ABC XXXX Current Liability 3 To Updated Hire Purchase Interest in Suspense.

DR BS Motor Vehicles 7000. ABC has the option to trade in the old car for a discount of 20000 on a new car. Can help me to have a check for the double entry that I write for the following.

There are four methods of accounting for hire purchase. Please journal entry for a trade-in vehicle. Hi Can anyone guide me what is the accounting double entry for selling of Fixed Asset - A Car.

300000 100000 3 years. Accumulated Depreciation 1000000 this removes the depreciation taken on the old van Credit. Lease accounting operating vs financing leases examples.

When I am purchased. To offset the fixed asset account. You are acquiring a motor vehicle that costs RM17500000 with a 5-year hire purchase plan.

The car costs 10000 and it requires to pay 30 initial payment and the remaining balance will be paid monthly with interest expense. Entries in Interest Account Depreciation Account and Profit Loss Account will be the same as have been passed under the first method. Debit Accumulated Depreciation for the cars accumulated depreciation.

So what is the double entry for.

Free 9 Vehicle Installment Purchase Agreement Samples Car Sale Payment

Solved Question One 30 1 1 The Managing Director Of Chegg Com

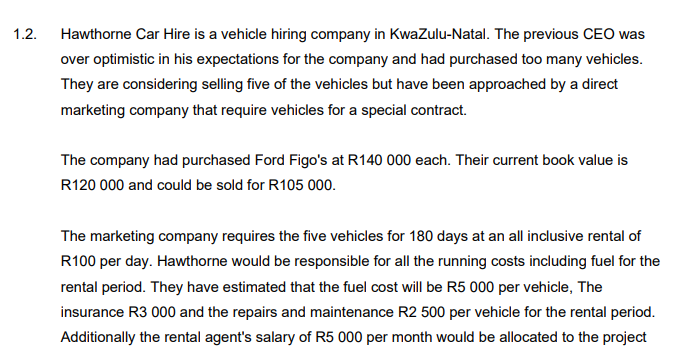

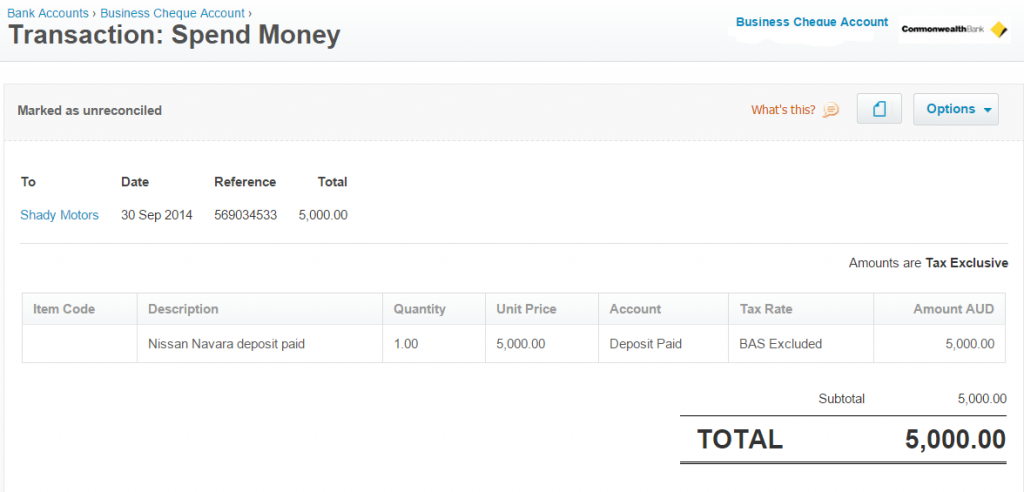

The Bookkeeping Behind An Asset Purchase Via A Chattel Mortgage E Bas Accounts

The Bookkeeping Behind An Asset Purchase Via A Chattel Mortgage E Bas Accounts

Accounting For Hire Purchase Accounting Education

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Evaluating Cloud Accounting Software Infographic Infographic Marketing Mobile Marketing Cloud Accounting

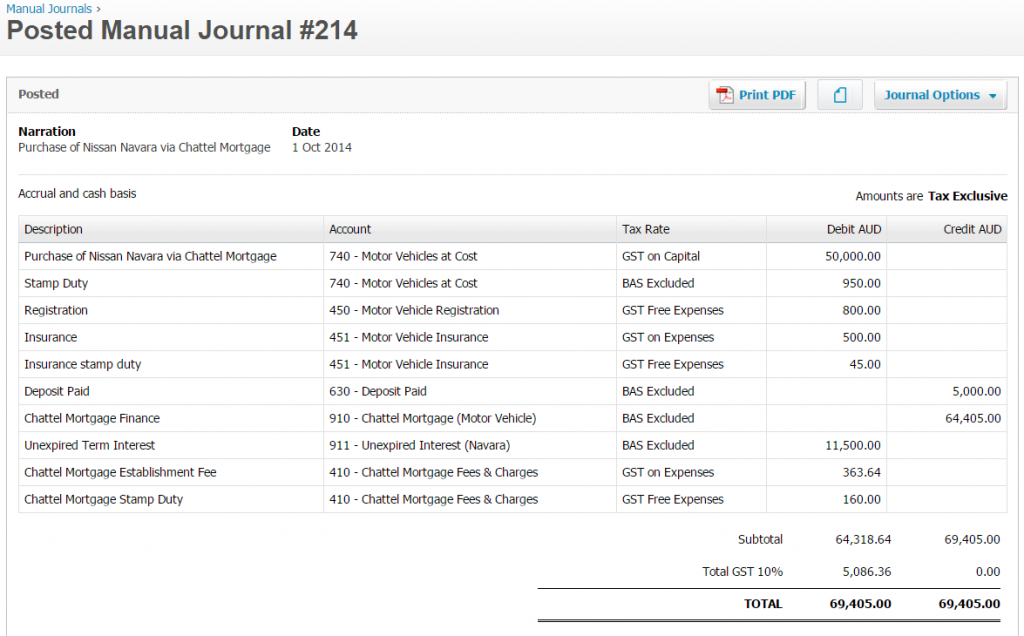

How To Record A Hire Purchase Agreement Solar Accounts Help

Free Printable Vehicle Expense Calculator Microsoft Excel

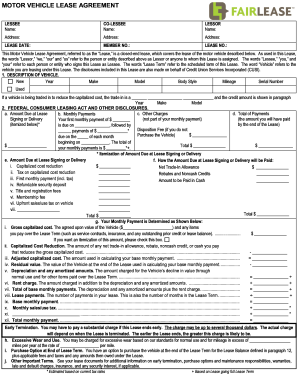

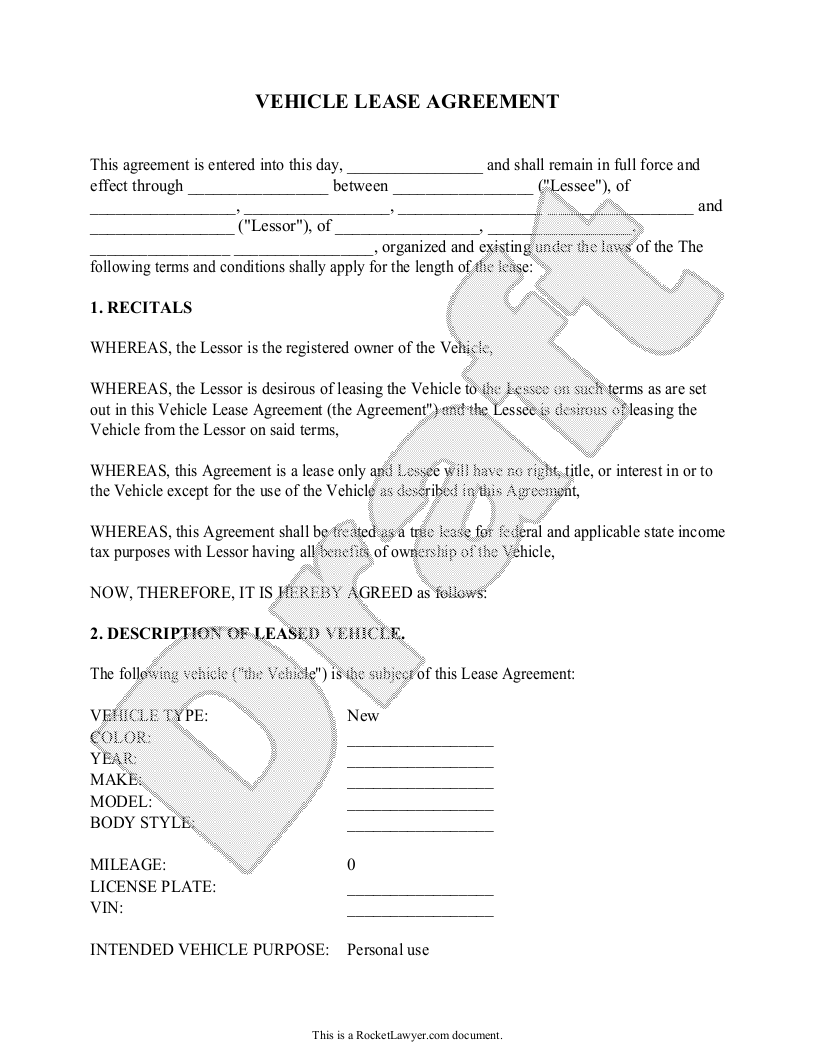

Vehicle Lease Agreement Form Fill Out And Sign Printable Pdf Template Signnow

Solved Journal Entries For Fixed Asset Sale Vehicle With A Loan Liability

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Label Template 21 Per Sheet Awesome Car Loan Agreement Template Word Paramythia Best Templates Ideas

Business Account Ownership Transfer Letter Templates At Allbusinesstemplates Com

Free Vehicle Lease Agreement Make Sign Rocket Lawyer

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

:max_bytes(150000):strip_icc()/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)